Matthew Sigel, Head of Digital Assets Research at VanEck, recently joined OPTO Sessions to discuss: the upcoming bitcoin halving event; how the US general election will impact its price movements; and the regions that are adding bitcoin to their reserves.

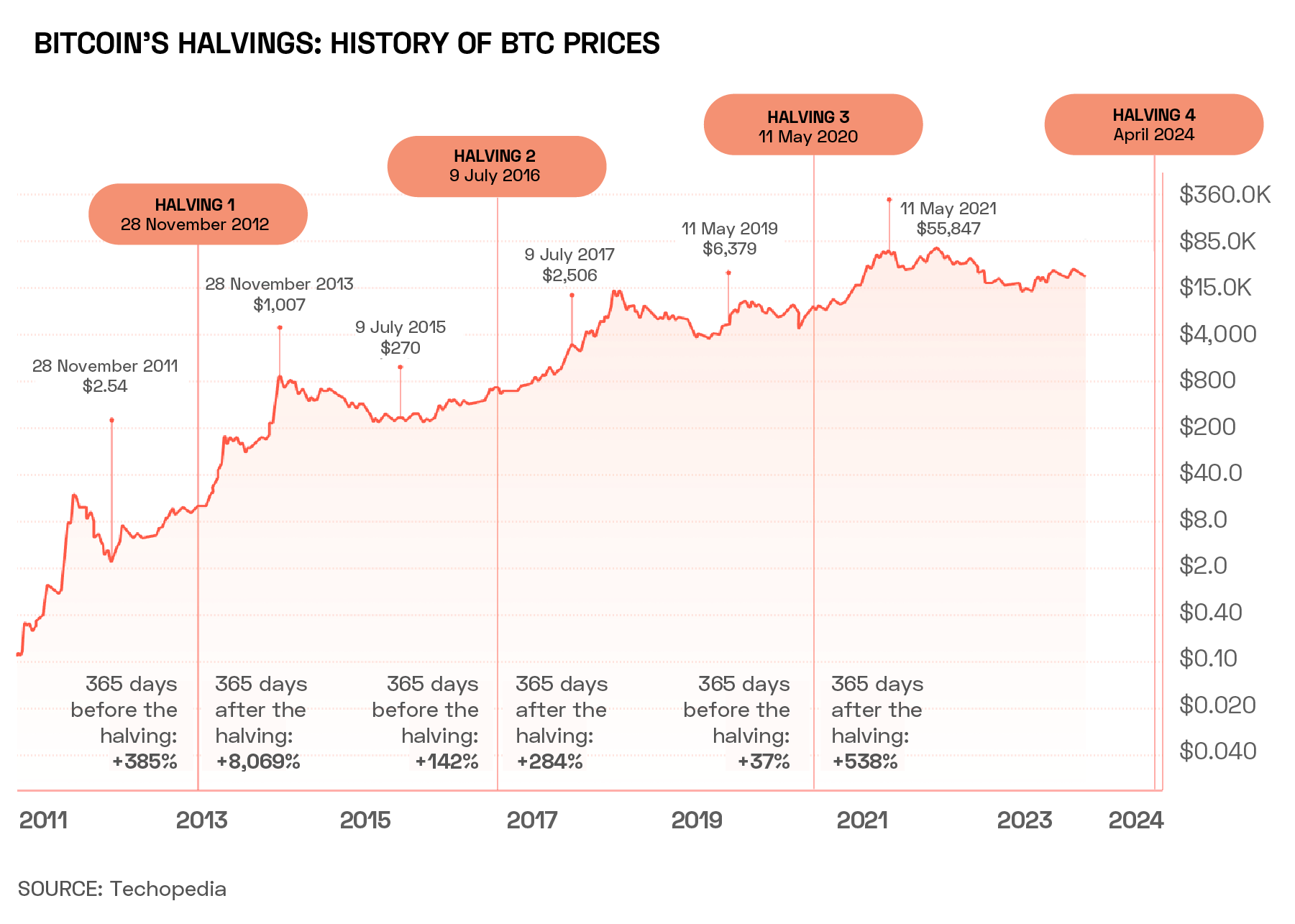

With every 210,000 blocks mined — in other words, every four years approximately — a bitcoin ‘halving’ event occurs. The next halving event is expected in April 2024.

“Right now, each Bitcoin block every 10 minutes contains 6.25 bitcoins in rewards to miners who successfully solve the algorithm. About 100 days from today, in early to mid-April, the Bitcoin algorithm will change again, and that reward rate will drop to 3.125 Bitcoin every 10 minutes,” explains Matthew Sigel, Head of Digital Assets Research at VanEck, in a recent conversation with OPTO Sessions.

This cuts in half the rate at which new bitcoins are added into circulation. In theory, this maintains demand for bitcoin. Historically, explains Sigel, this leads to the price of bitcoin doubling within a year of the halving event.

“If there’s suddenly a supply shock, and new supply is cut by half, then the prices should theoretically react strongly and at least double over the subsequent six to 12 months.”

The Game Theory of Bitcoin Miners

The mechanics of this pricing change are complex.

Sigel points out that the sudden cut to rewards makes mining activity unviable for miners who were barely profitable before the halving. As a result, they will either be forced to sell a greater portion of their mined bitcoins — creating a short-term supply glut — or go bankrupt. Either way, the more profitable miners can increase their own market share at relatively low costs if they are able to continue operations and time the purchase of new bitcoins well.

Timing is key, however, and that part is uncertain. Sigel points out that it is not unusual for prices to fall 20% or more during the days and weeks immediately following the halving.

One key milestone is the US general election in November. Halving events occur in the same years as US elections. Some (including Sigel) believe this was an intentional move from bitcoin’s inventor, Satoshi Nakamoto.

“We may not see the really explosive gains until the US election uncertainty is resolved,” Sigel explains. “That would mean Q4.” Bitcoin posted a (then) all-time high on 30 November 2020, just over three weeks after the 2020 election.

Supply, Demand and Inflation

The consensus is that the Federal Reserve (Fed) will pivot from the tightening cycle it has implemented over the past two years in 2024, and could even begin cutting rates in order to make credit more accessible.

While loose monetary policy is inherently inflationary, some experts — like Jeff Booth, General Partner of bitcoin-only venture fund egodeath.capital — say that cryptocurrencies can act as a hedge against inflation, due to the fact that its supply is finite. (Meanwhile, others — such as a team of analysts at S&P Global — say that bitcoin’s track record isn’t long enough to make a definitive statement).

“Where we see the value of bitcoin is potentially protecting folks from fiat debasement,” says Sigel.

“When you look around the world at the countries that are mining Bitcoin for their own reserves, it’s El Salvador, the UAE, Oman and Bhutan. It’s countries in the Middle East, Latin America and Asia where penetration is rising, and where objections to the US fiscal situation can be expressed through this new asset class.”

Bitcoin critics point out that during 2022, when inflation was rife, bitcoin prices fell, contradicting the view that the cryptocurrency acts as an effective hedge. However, Sigel believes that this is a result of how national governments approached inflation itself.

“Policymakers saw this rising inflation and took the view that it was driven by greedy corporations and supply chain issues, and that it can be fixed if they just micromanaged the financial system a little bit more.

“Micromanagement is an illness which is anti-crypto, in my view.”

LINKS TO THE INTERVIEW:

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy