Adam Taggart, CEO and Founder of Thoughtful Money, discusses how artificial intelligence promises productivity gains, but also creates a risk of technological displacement. This dynamic is playing out against a backdrop of underemployment and the over-concentration of wealth, which he believes together threaten social cohesion.

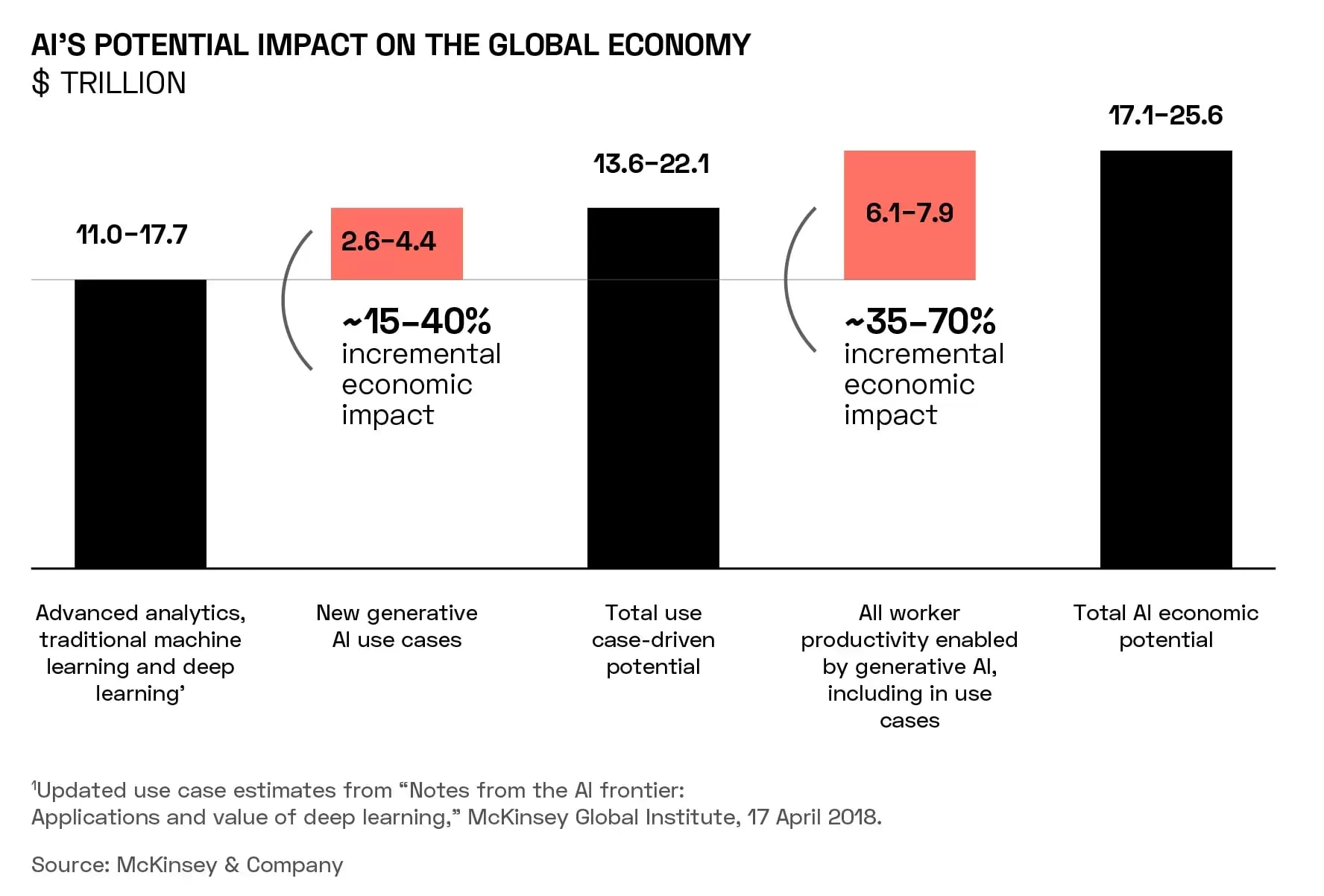

In June 2023, strategy consultancy McKinsey estimated that the potential global economic impact of generative artificial intelligence (AI) could be as much as $4.4trn annually — greater than the GDP of the UK. This figure was reached by assessing possible productivity gains across 63 use cases in just four business areas.

“AI, essentially, is a productivity tool,” says Adam Taggart, CEO and Founder of Thoughtful Money, on OPTO Sessions.

As such, it has the potential to benefit stock markets by increasing business productivity, revenue and profits, as well as global GDP.

Despite this, Taggart is of the opinion that its impact is currently overpriced by markets.

“Will it be the ultimate gamechanger in the timeline that the market is pricing it in right now? I'm sceptical.”

He singles out Nvidia [NVDA] as an example of a stock that currently appears to be overvalued. As of 15 February, Nvidia’s price to sales ratio was 40.45, compared to an average of 4.94 across the Nasdaq 100, and 2.72 for the S&P 500, according to Bloomberg data.

“I'm certainly sceptical that a company like Nvidia is worth anywhere near what it's currently trading at,” says Taggart.

Technological Displacement

Taggart has another, greater concern related to AI and its potential productivity gains, namely: what happens to the human labour that AI displaces?

“Technology has always replaced human labour, ever since the industrial age. And it should, where it can work more efficiently,” he begins.

However, Taggart refers to the work of economist John Maynard Keynes, who popularised the phrase ‘technological unemployment’ in a 1930 essay entitled ‘Economic Possibilities for our Grandchildren’, defining it as “discovery of means of economising the use of labour outrunning the pace at which we can find new uses for labour” — in other words, displacing labour with technology faster than the labour can be repurposed elsewhere.

“Will it be the ultimate gamechanger in the timeline that the market is pricing it in right now? I'm sceptical.”

If the pace of displacement isn’t appropriately managed, then, in Taggart’s words, “you end up creating a social problem whose cost is oftentimes greater than the benefits you get from the introduction of the technology”.

Given the pace at which AI technology is advancing and the breadth of its impact across the labour market, Taggart feels that there is a real danger of AI having disruptive, detrimental impacts on labour markets.

Under-Employment

The technological unemployment which could potentially result from AI feeds into a broader, more complex set of issues that are already at play in advanced economies, particularly the US.

“Add to that new technologies, with AI at the forefront of that wave, that are fast enabling companies to employ fewer and fewer humans. I think that’s a real dangerous cocktail for this technological displacement problem that Keynes warned about.”

On the one hand, the inactive workforce in the US already numbers over 100 million. This labour under-utilisation is exacerbated by increasing immigration, according to Taggart.

“Add to that new technologies, with AI at the forefront of that wave, that are fast enabling companies to employ fewer and fewer humans. I think that’s a real dangerous cocktail for this technological displacement problem that Keynes warned about.”

However, there is an important caveat to this argument, in that the US has a rapidly ageing population, with birth rates slowing dramatically.

“Unless we can get the US birth rate up dramatically in the coming decades, which I think will be a pretty hard thing to achieve, immigration is going to have to be a really big part of the solution.”

The End of the Social Contract?

The US’ complex economic situation threatens the very fabric of society, according to Taggart.

“We are having a real bifurcation of society,” he says. “The spoils of the bounty are finding their way into fewer and fewer pockets.”

There are two significant demographic changes that this is prompting in the US and other developed economies. On the one hand, the middle class is shrinking — becoming “an endangered species”, in Taggart’s words.

Simultaneously, it is causing a generational divide. “Younger generations — millennials and certainly Gen Z — in a lot of ways are becoming so despondent about their future prospects, that they're kind of giving up on the social contract.”

Established trajectories, like taking out debt to attend higher education and using that investment to pursue a career, aren’t delivering the rewards they used to promise.

“I feel that there is this brewing social crisis, that we’re beginning to see some visible fault lines begin to emerge, but it’s still not in the national dialogue” says Taggart.

He views this as one of the paramount economic problems facing developed economies; one that transcends the short- to medium-term movements of the stock market.

“In developed countries, we want people to believe in the fairness of the system so that they'll invest themselves in it. That’s what capitalism is. That’s how you build economic prosperity in a country.

“If people start losing faith in that and opting out — well, yeah, there goes your economic destiny.”

LINKS TO THE INTERVIEW:

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy