As the 5G rollout revolution continued to gather pace, 2023 saw the announcement of some major agreements to support 5G devices. The industry also warned of a temporary slowdown in investment in 5G. Here is a collection of stocks to watch based on updates from the sector over the last 12 months.

- Qualcomm announced it will supply Apple with chips for smartphone releases between 2024 and 2026.

- Nokia received approval from the US Federal Communications Commission for its 5G drone solution.

- American Tower warned in October of a temporary slowdown in 5G investment.

Broadcom

The Apple Supplier Stock

Broadcom [AVGO] was tapped by Apple [AAPL] in May to build “cutting-edge wireless [5G] connectivity components” at its manufacturing facility in Fort Collins, Colorado. The partnership is part of the iPhone maker’s planned $430bn investment in US manufacturing over the next five years. “We’re thrilled to make commitments that harness the ingenuity, creativity, and innovative spirit of American manufacturing,” commented Apple CEO Tim Cook in a press release. The Broadcom share price soared 104.2% in 2023.

Qualcomm

The iPhone Chip Stock

In 2023, Apple also inked a deal with Qualcomm [QCOM], another chipmaking giant. It was announced in September that Qualcomm will supply its Snapdragon 5G Modem‑RF Systems for the Cupertino company’s smartphone launches between 2024 and 2026. “This agreement reinforces Qualcomm's track record of sustained leadership across 5G technologies and products,” read a press release. The Qualcomm share price rose 35.1% in 2023.

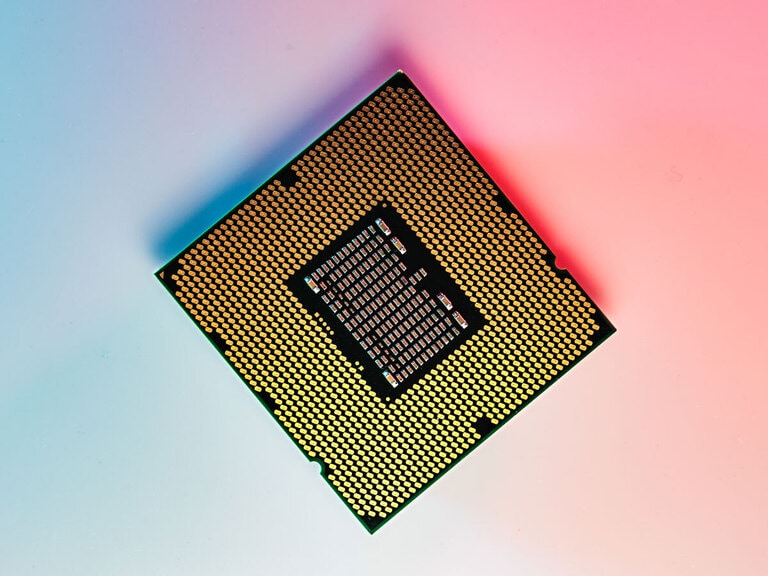

Intel

The System-on-Chips Stock

Intel [INTC] announced a 5G partnership with Swedish telecom giant Ericsson in July, which will see the chipmaker manufacture customised 5G system-on-chips that will help Ericsson develop an advanced 5G infrastructure. “This agreement exemplifies our shared vision to innovate and transform network connectivity, and it reinforces the growing customer confidence in our process and manufacturing technology,” said Sachin Katti, Senior Vice President and General Manager for Intel’s Network and Edge group in a press release. The Intel share price gained 94.5% in 2023.

Nokia

The 5G Drone Stock

Nokia’s [NOK] drone-in-a-box — a collaboration with electronics group Rodhe & Schwarz — was cleared for take-off by the US Federal Communications Commission in December. Thomas Eder, Nokia’s Head of Embedded Wireless Solutions, said in a statement that the company is “shaping the path in the US for industrial and public sector use cases, improved 5G spectrum monetisation and the nationwide rollout of drones”. The Nokia share price fell 22.7% in 2023.

American Tower

The Investment Outlook Stock

American Tower [AMT] intimated on its third quarter 2023 earnings call in October that 5G investment was slowing down, but only in the medium term. President and CEO Tom Bartlett explained that the company is in the midst of three phases — “two peak periods of spend that are bridged by a temporary phase of more moderate activity”. The first phase is currently winding down, and the market is heading into the second, Bartlett added. The American Tower share price rose 5.4% in 2023.

Another Way to Invest in 5G

The Defiance 5G ETF

The Defiance 5G ETF [FIVG] holds all five stocks. As of 30 September, 35.4% of the portfolio was allocated to ‘cloud-core’ technologies, while 5G-enabled device chips had a 14.1% weighting; cell tower and data centre REITs accounted for 4.4%. The fund gained 21.9% through 2023.

The iShares Future Cloud 5G and Tech ETF [IDAT] also holds all five stocks. As of 28 December, the fund is weighted heavily in favour of information technology (84.1%), followed by the real estate (6.9%), communication (6.2%) and materials (2.5%) sectors. The fund gained 32.5% over the course of 2023.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy